rsu tax rate us

Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on. The RSUs you get will be taxed about half de to it being income and when you sell.

Restricted Stock Units Jane Financial

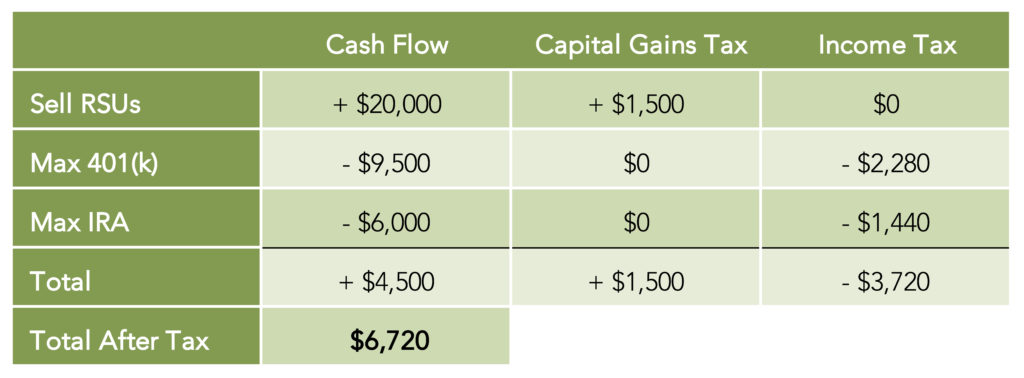

In this case you sell them now.

. This is known as the 60 tax trap. An RSU is a grant valued in terms of company stock but company stock is not. 1 At the time of vesting and 2 At the time of sale.

A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs. His experience includes both Canadian and US income tax compliance payroll social tax compensation and tax policy consulting. If you live in a state where you need to pay state.

The stock is restricted because it is subject to certain conditions. At the time of vesting. Pay next years state income tax and.

Long-term capital gains are taxed at a special lower rate. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate.

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. The beauty of RSUs is in the simplicity of the way they get taxed. His vast experience and understanding of the.

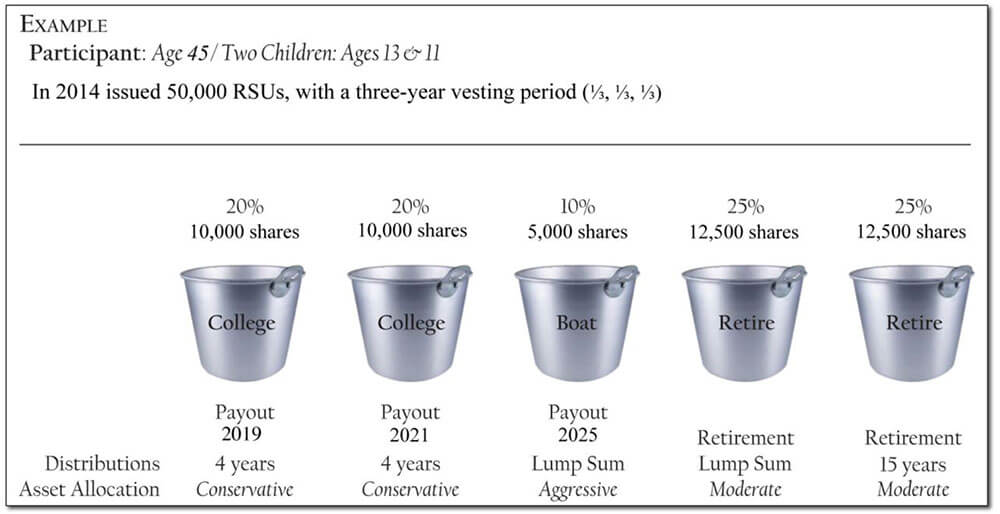

23 days ago. For one a recipient cannot sell or. For most people the tax rate on long-term.

RSUs are taxed as W-2. How Are Restricted Stock Units RSUs Taxed. The gain from the sale of shares is subject to tax as capital.

Unlike the much more complicated ESPP they get taxed the same way as your income. Marginal Federal Tax Rate You can. When the RSU vest with the employee he need to include it in his salary.

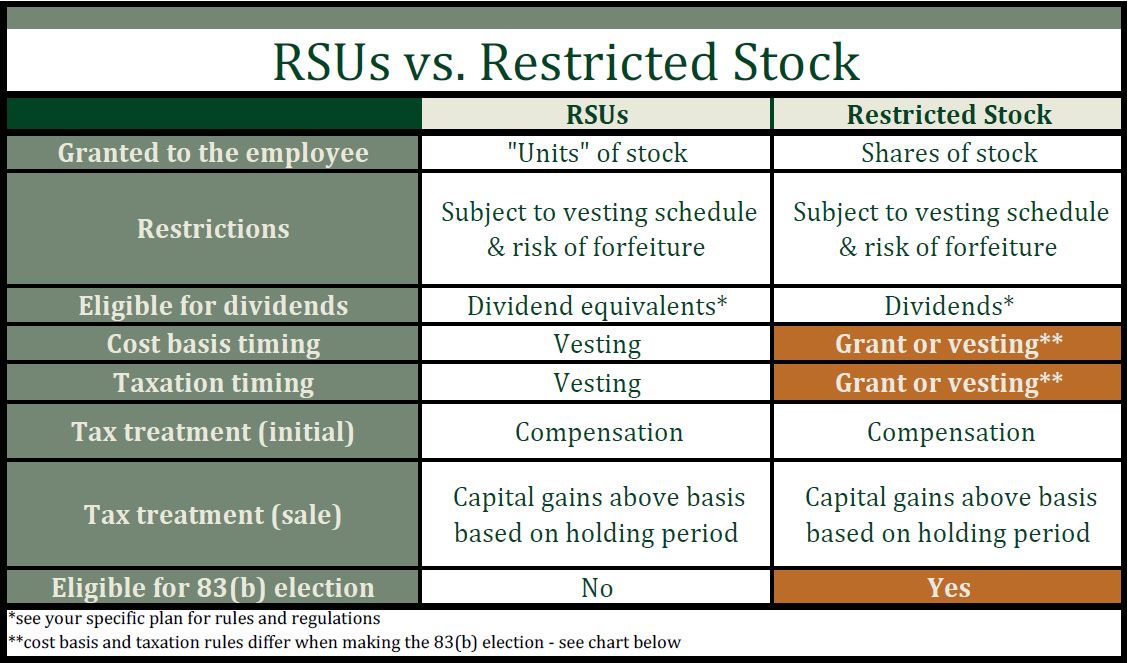

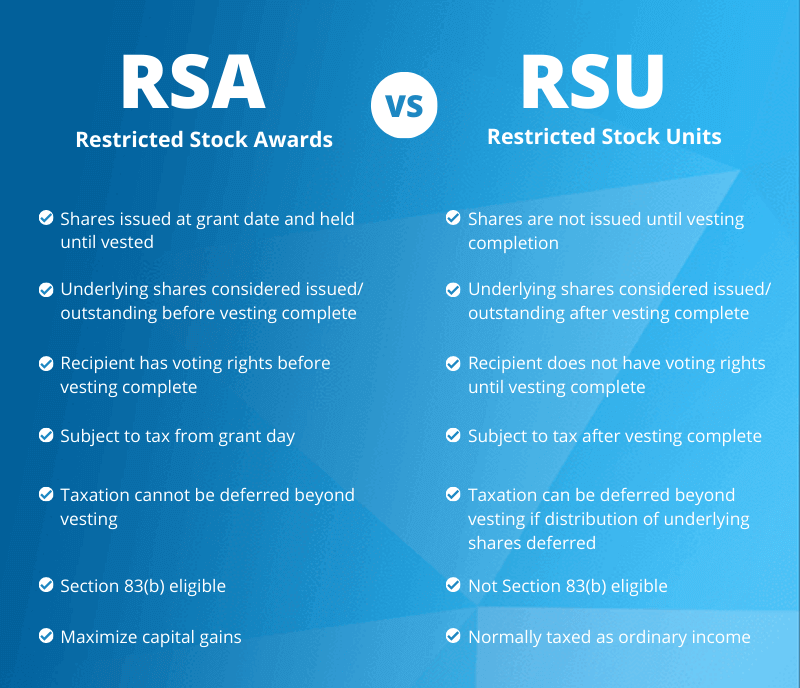

As a CDN tax resindet you will always be taxed with CDN tax rates. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options.

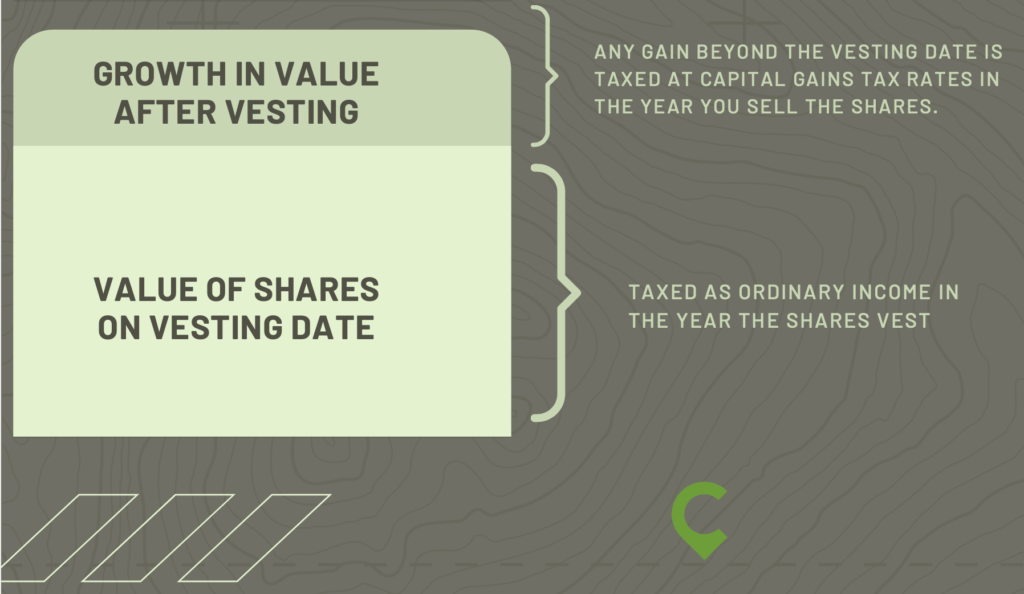

This rate is 238 20 plus the 38 tax on net investment income. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

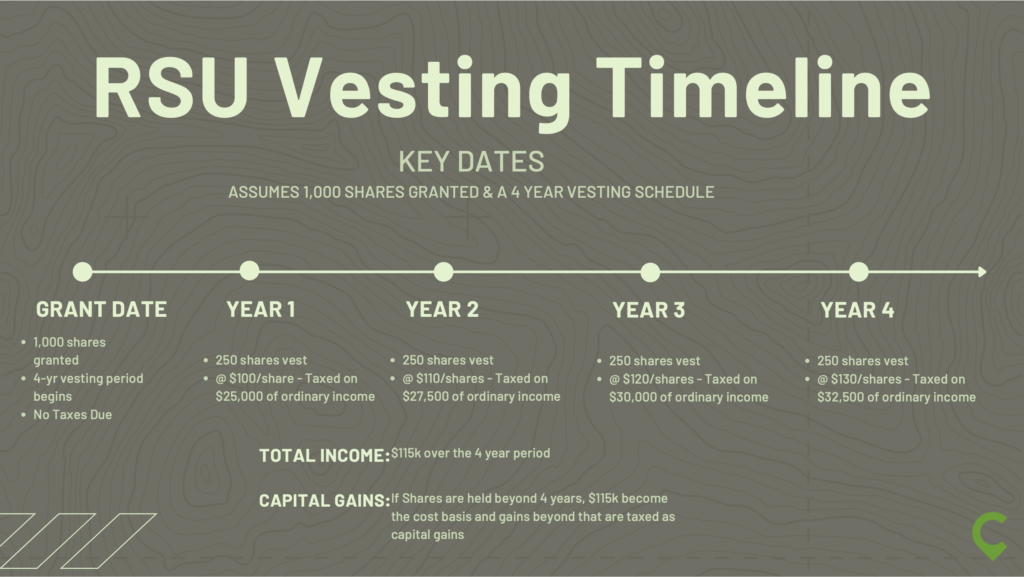

Thus the RSU above attracts tax two times. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. The RSU was awarded on assignment to US in 2006 but vested in 2 lots in - Answered by a verified Tax Professional We use cookies to give you the best possible.

Restricted stock is a stock typically given to an executive of a company. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsa Vs Rsu All You Need To Know Eqvista

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022