payment plan for mississippi state taxes

Please allow 8-10 weeks to process the request. There are several options available when making a payment to your student account.

Democratic state senators have proposed giving all licensed adult drivers a one-time payment of 200 toward fueling up.

. Include name address social security number contact number and detailed explanation. As a married filing jointly if you make 36600 you wont pay any taxes on income in the state. Payment plan for mississippi state taxes.

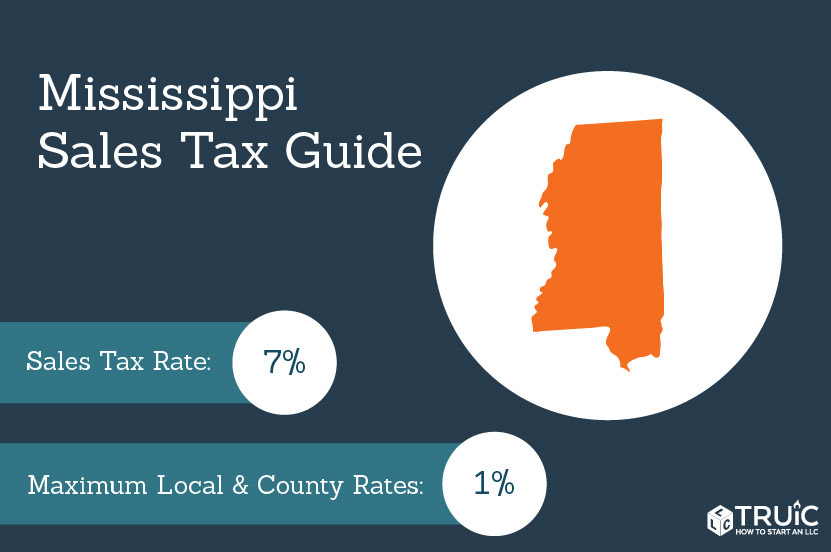

Complete the requested information and submit. You can also make payments with a debit or credit card online. Mississippis income tax ranges between 3 and 5.

The MO DOR charges a convenience fee between 125 and 215 for payments under 100. A downloadable PDF list of all available Individual Income Tax Forms. Select Make an Estimated Payment from the left hand menu.

Please work with the hotel merchant or vendor to confirm the requirements of the specific State. If someone makes less than 5000 they pay a minimum of 3. If your payment is 100 or more the processing fee is 215.

How to Make a Credit Card Payment. Free Consult 30 Second Quote. Income Tax Estimate Payments.

Students enroll in the plan after logging into the QuikPAY system in their myState account. Prepare Your 2021 2022 Mississippi State Taxes Online Now. Mail your request to.

Add the additional amount or percentage elected by the employee to the pay period tax calculated in step 8 and round to the nearest dollar to determine the amount of tax to be. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Taxpayer Access Point Payment.

Tate Reeves on Tuesday signed a bill that. 416 4 Enter the amount due each month interest will continue until you pay in full 2 Enter the total amount you owe as shown on your return 3 Enter the amount of any payment you are making. Jackson MS 39215-1033.

Most people can use some form of IRS Form 1040 to determine how much theyll pay in. Free Case Review Begin Online. You can make Estimate Payments through TAP.

Income Tax Calculator 2021. See If You Qualify For IRS Fresh Start Program. If you submit the paper application you must include your checking account details so the payment plan can begin immediately if accepted.

We confirm most requests within 24 business hours. You will provide credit card or bank account information when enrolling in the plan to allow. House Bill 531 brings the largest tax cut in Mississippi history.

If you plan to apply on or near July 5 2022 but have not received a Sales Tax Permit please submit. The rate increases with income in between. In 2025 it will drop again to 44 and then in 2026 it will reach 4.

Thats roughly what the average North Carolinian pays in state gas taxes. You will be taxed 3 on any earnings between 2001. You can make estimate payments through tap.

Mississippi State University PO Box 5328 158 Garner Hall 88 Garner Circle Barr Avenue Mississippi State MS. Penalty and interest continue to be assessed on any unpaid balance until you pay the debt in full. 12 month installment plan.

Box 5328 Mississippi State MS 39762. The state uses a simple formula to determine how much someone owes. Individual Income Tax Division.

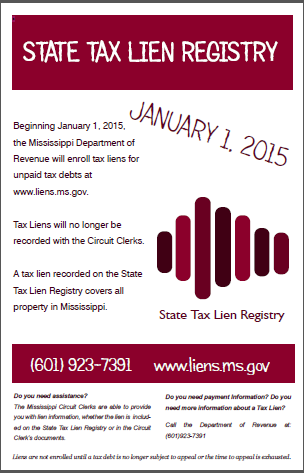

Select the Request a Payment Plan option. Mississippi Tax Payment Plan. Taxpayer Access Point TAP Online access to your tax account is available through TAP.

To request a payment plan. You should request a tracer from the Department of Revenue in writing. The plan will split the total amount due into four payments.

Payment plans may not be for longer than 60 months and the minimum monthly payment is 25. 9 month installment plan. Starting July 1 taxes on that amount will drop from 5 to 47.

The cost to enroll in the payment plan each semester is 50. Mississippis State Tax Payment Plan or Installment Agreement. Under this new law the states income tax will gradually be reduced to a 4 flat tax on income over 5000.

Affordable Reliable Services. Individuals and businesses can apply. There are several options available when making a payment to your student account.

This website provides information about the various taxes administered access to online filing and forms. However the taxpayer must consider other alternatives as an installment. Curious how much you might pay in federal and state taxes this year.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Students may choose to pay in full or enroll in a payment plan. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck.

If someone makes more than 10000 they pay a maximum of 5. Non-refundable enrollment fee of 5000 due at the time the plan is established. When a Mississippi taxpayer cannot pay off their taxes in certain cases a taxpayer can set up an installment agreement with the Mississippi Department of Revenue.

To find a tax professional that has experience addressing Mississippi state tax problems consider doing a. AP Several new laws take effect in Mississippi on Friday which is also the first day of the new state budget year. If you live in mississippi.

The information below is based on available information from the State taxation authority. Box 23050 Jackson MS 39225-3050. If a taxpayer cannot pay off Mississippi state in one payment due to financial difficulties the MS DOR just like the IRS allows taxpayers to pay off tax liabilities over a series of monthly payments.

AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. 6 month installment plan. Take Advantage of Fresh Start Options.

All other income tax returns. 1 Enter the tax year for which you are making this request Instructions MUST BE ATTACHED TO FRONT OF RETURN Mississippi Installment Agreement Form 71-661-16-8-1-000 Rev. You can make payments for billings audits and other liabilities in TAP.

Mississippis State Tax Payment Plan or Installment Agreement. Log into the TransAction Portal TAP. 2 days agoJACKSON Miss.

The due date for filing a ms tax return and submitting ms payments is april 18 2022. If you are receiving a refund. 9 month installment plan.

1 day agoIf you make less than 18300 a year as a single filer you wont pay any taxes. Ad Based On Circumstances You May Already Qualify For Tax Relief. Department of Revenue - State Tax Forms.

E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft. Ad Tax Relief up to 95. There is no fee.

Should the hotel merchant or vendor have any questions they should reach out directly to the State for clarification.

Top Reasons For Irs Tax Audits Irs Taxes Debt Relief Programs Tax Debt

Mississippi Senate Passes Income Tax Cut Slashing 446 Million

Power Of Attorney Form Mississippi 4 Common Mistakes Everyone Makes In Power Of Attorney For Power Of Attorney Power Of Attorney Form Attorneys

Mississippi Sales Tax Small Business Guide Truic

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Account Refunds Office Of The Controller And Treasurer Mississippi State University

How To Become A Physical Therapy Assistant Pta Requirements Physical Therapy Assistant Physical Therapist Assistant Physical Therapy Education

![]()

Gov Reeves Signs 524 Million Tax Cut As Education Infrastructure Funding Woes Remain Jackson Free Press Jackson Ms

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization

Where S My Refund Mississippi H R Block

Mississippi Income Tax Calculator Smartasset

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Pin On 529 College Savings Plan Board 529 Plans

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi News Us News

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

Financial Literacy For Educators And Other Professionals 5 Refreshing Ways To Spend Your Tax Refund Tax Refund Financial Literacy Personal Financial Literacy